Mitigating the Risks of Unforeseen Repairs in Real Estate

Understanding the Financial Impact of Unforeseen Repairs

Unforeseen repairs can significantly strain your real estate budget. Imagine purchasing a charming older home, only to discover that the roof needs immediate replacement. Such surprises not only cost money but can also derail your investment plans.

An ounce of prevention is worth a pound of cure.

When repairs arise unexpectedly, they often lead to unplanned expenses that can take a toll on your finances. This can result in cash flow issues, especially if you rely on rental income to cover your mortgage and other costs.

Being aware of the potential financial impact can motivate you to take proactive steps, ensuring you have a financial cushion for these situations. Having a reserve fund can be your safety net when repairs pop up unexpectedly.

Conducting Thorough Property Inspections Before Purchase

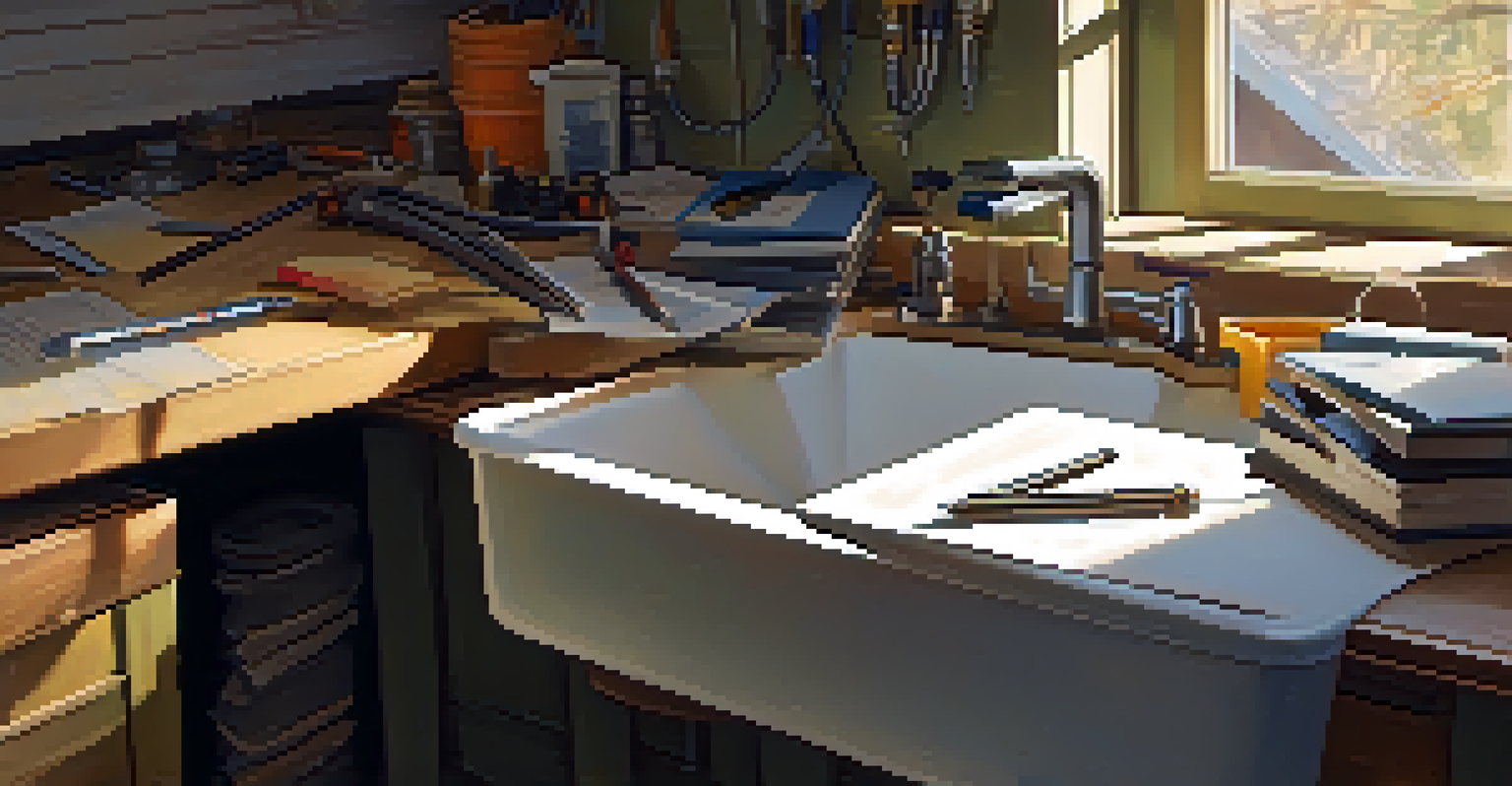

One of the best ways to avoid unforeseen repairs is by conducting a thorough property inspection before making a purchase. Hiring a qualified inspector can reveal potential issues that could require attention down the line.

For instance, hidden plumbing problems or outdated electrical systems may not be obvious at first glance. By identifying these concerns early, you can negotiate repairs with the seller or adjust your budget accordingly.

Financial Impact of Unforeseen Repairs

Unforeseen repairs can strain your budget, leading to cash flow issues if not properly planned for.

Additionally, being proactive with inspections can save you both time and money in the long run. It’s like checking the weather before going on a trip; it helps you prepare for what’s ahead.

Investing in Quality Home Warranty Plans

A home warranty can be a smart investment to mitigate the risks of unforeseen repairs. These plans typically cover major systems and appliances, providing peace of mind to homeowners.

The best way to predict the future is to create it.

For example, if your HVAC system fails unexpectedly, a home warranty can cover repair costs, saving you from a hefty bill. This can be especially beneficial for investment properties where unexpected expenses can quickly eat into your profits.

While home warranties require an upfront cost, they can be invaluable during emergencies. It’s like having a safety net that catches you when you fall.

Setting Aside a Contingency Fund for Repairs

Creating a contingency fund is another effective strategy for managing unforeseen repairs. This fund acts as your financial buffer, helping you cover unexpected expenses without derailing your overall budget.

Typically, setting aside 1% to 3% of your property’s value annually can provide a solid foundation for this fund. For instance, if you own a property worth $300,000, aiming for a fund of $3,000 to $9,000 can give you peace of mind.

Importance of Property Inspections

Conducting thorough property inspections before purchase can help identify potential issues and save money.

Having this reserve allows you to tackle repairs promptly, ensuring they don’t escalate into larger, more costly issues. Think of it as your rainy-day fund, ready for when the storm hits.

Keeping Up with Regular Maintenance Tasks

Regular maintenance is essential in preventing unforeseen repairs from cropping up. By routinely inspecting and caring for your property, you can catch small issues before they become major headaches.

For example, cleaning gutters can prevent water damage, while servicing your HVAC system regularly can extend its lifespan. These small, consistent efforts can save you significant amounts of money over time.

Creating a maintenance schedule can help ensure that nothing falls through the cracks. It’s a bit like regular check-ups at the doctor; they help catch problems early.

Understanding Local Real Estate Market Trends

Being aware of local real estate market trends can help you anticipate potential repair issues. Different areas have unique characteristics that can influence the maintenance needs of properties.

For instance, homes in regions with harsh weather conditions may require more frequent repairs than those in milder climates. Understanding these factors can guide your investment choices and prepare you for potential future expenses.

Creating a Contingency Fund

Setting aside a contingency fund allows you to manage unexpected repair expenses without disrupting your finances.

Staying informed about the market can also help you make more strategic decisions regarding property improvements. It’s like knowing the lay of the land before embarking on a journey.

Consulting with Real Estate Professionals for Guidance

Consulting with experienced real estate professionals can provide valuable insights into mitigating repair risks. Realtors, property managers, and contractors often have firsthand knowledge of common issues in specific areas.

For example, they may inform you about prevalent plumbing issues in older homes or point out neighborhood trends that could affect property values. Their expertise can help you make informed decisions that protect your investment.

Building a network of trusted professionals can also facilitate quicker resolutions when issues arise. Think of them as your guides, helping you navigate the complex landscape of real estate.

Leveraging Technology for Property Management

In today’s digital age, leveraging technology can greatly assist in managing unforeseen repairs. Property management software can help you track maintenance schedules and reminders effectively.

For instance, using apps to manage communication with tenants can streamline reporting issues as they arise. This proactive approach allows you to address repairs before they escalate into larger problems.

Additionally, technology can provide insights into the health of your property through smart home devices. It’s like having a personal assistant keeping an eye on things while you focus on growing your investment.